Empowering transformations within banks and insurers in a sustainable way

25 June 2024Meet the team Pragmatic Advisory & Implementation for Financial Institutions.

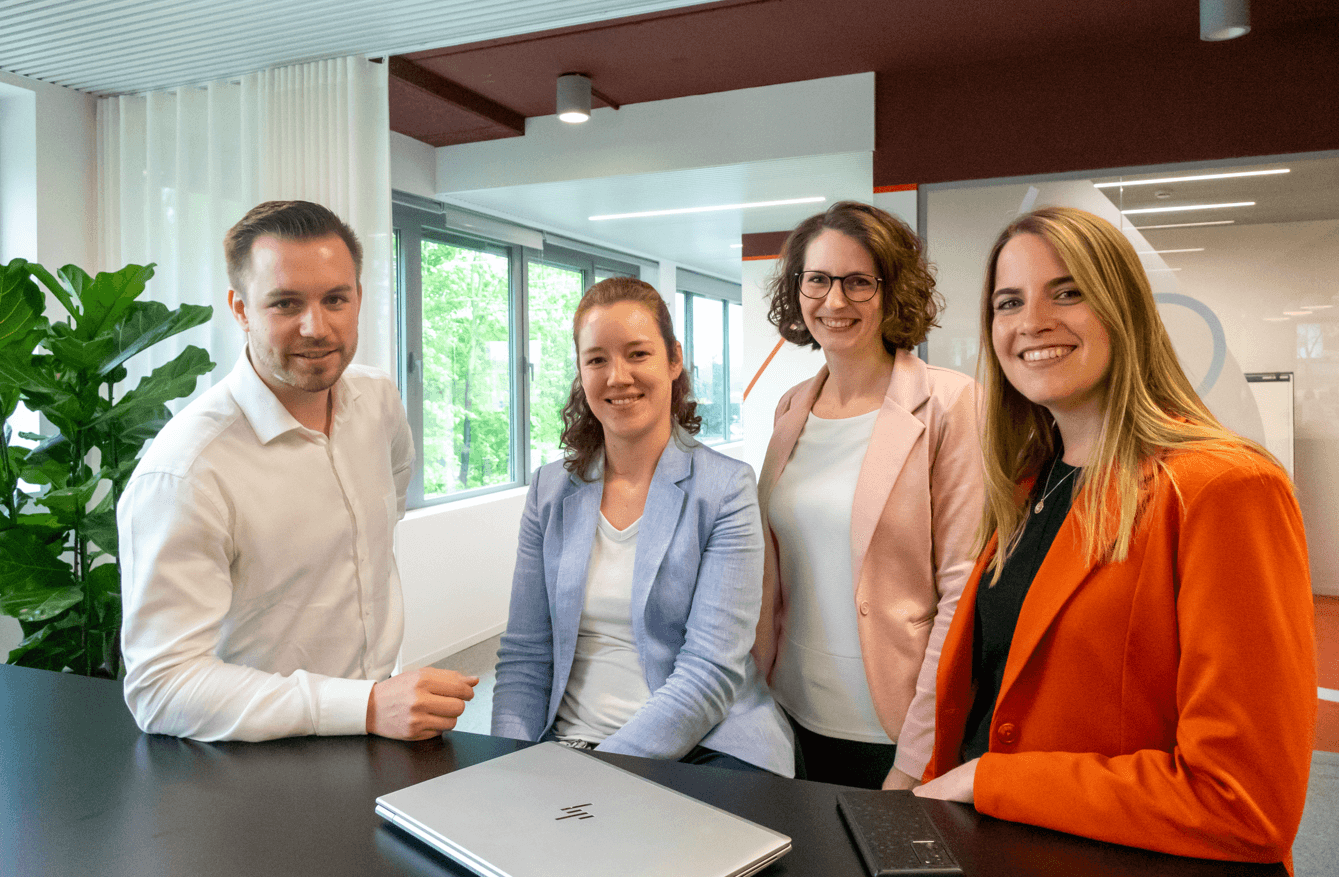

At TriFinance, a team of about thirty multidisciplinary professionals focus specifically on delivering advisory services for financial institutions: they support, lead and guide transformation projects at banks and insurers in finance, risk and operations. To gain a comprehensive understanding of their activities, team dynamics, and culture, we spoke with Business Unit Lead Stéphanie Struelens, consultants Inne Vermeiren and Olivier Renard, and Care Manager Laura Evenepoel.

Leading Transformation Projects at Financial Institutions : business process management, business integration, and sustainability services.

Leading transformation projects involves guiding organizations through significant changes to improve their operations, comply with new regulations, or achieve strategic goals such as mergers and acquisitions. When a bank or an insurer is at the foot of a change, we help them define the vision, ambition, and goals of the transformation. We also design, implement, and embed the solution within their environment. To do so, “we analyze the situation from different perspectives: systems, processes, data, organization and governance, and people” explains Stéphanie Struelens. "Our passion lies in creating end-to-end solutions, from design to full implementation. This is not just what we do; it is what we love to do, and we fully embrace it. Our activities include coordinating projects, facilitating workshops, developing customer journeys and processes, defining business requirements, ensuring smooth business integration (bridging the gap between business and IT or business and external partners), testing the solution, training and guiding teams, and managing communication and change.”

These transformations are often complex and multifaceted, requiring expertise in several key areas: business process management (BPM), business integration, and sustainability.

Our passion lies in creating end-to-end solutions, from design to full implementation. This is not just what we do; it is what we love to do, and we fully embrace it.

Stéphanie Struelens - Lead - Pragmatic Advisory & Implementation Financial Institutions

Business process management:

“Business process management starts with a thorough scan,” explains Inne Vermeiren. “We study how certain processes are running today and how we can optimize them. We challenge not only the process itself but also the related risks and controls, KPIs and other performance metrics, possibilities for digitalization and automation (such as RPA systems and AI), the structure of the department and interactions between teams (including logical breakdown of activities, centralization versus decentralization, and outsourcing decisions), the management of priorities and backlogs, and the skills required or needing to be upskilled.

“Depending on the client’s needs, we can propose both quick wins and complete changes, then fully guide the implementation of the chosen solution.” says Stéphanie Struelens. When it comes to a significant redesign of a process, the consultants draw on the extensive experience of the business unit. “In such a project, we fully embrace our advisory role, drawing on the best practices we've encountered across the industry,”

Business integration:

Business integration involves implementing apps, systems or platforms, like the banking or insurance core system, a workflow management system or a reporting system, to name a few. The team fulfills various roles: the first one is defining and challenging the business needs and customer journeys, identifying suppliers, evaluating their proposals, making a thoughtful choice tailored to the client’s budget and needs, supporting or managing the implementation, ensuring successful adoption of the new software, and providing aftercare and continuous improvement processes. “By working with a wide range of partners, we maintain a neutral stance, ensuring the best solutions for our clients. We act as translators and really serve as a bridge between the client and suppliers, where we also take on an appreciated role as a challenger, and sometimes even between departments,” says Olivier Renard.

Sustainability:

The highly topical third pillar, consists of three facets. The first is shaping a sustainability strategy tailored to the client. The second facet involves implementing regulations. “As for every regulation, we use the reporting obligations as an opportunity to evaluate the data model and associated processes,” says Stéphanie Struelens. The third facet relates to concrete sustainability initiatives, particularly on a social level. In essence, financial institutions have a sustainable purpose: by making clients’ projects possible and dreams come true, they inherently have a social focus. Moreover, insurance offers a guarantee against risks related to these dreams, providing a safety net that encourages clients to pursue their goals. The presence of sustainable investment products in the bank's portfolio also proves that banks are quite progressive and open to change. Additionally, there is ample room for other initiatives, such as promoting the sustainability of careers, which further reinforces the institution's commitment to long-term social and environmental responsibility.

Driving sustainable transformations: a commitment to efficiency and customer experience

"No matter their career stage or specific roles, the members of the Pragmatic Advisory & Implementation Financial Institutions team always pursue sustainable transformations," Stéphanie Struelens says. “Every transformation has a reason, such as a merger, a new regulation or a process digitization. But you always want to link it to an efficiency gain or an improvement in the customer experience. Maximizing client satisfaction, reducing operational costs, and improving productivity are core objectives". By adopting new technologies and optimizing workflows, institutions can operate more effectively and reduce unnecessary expenditures. Enhancing how customers interact with the institution is equally critical. This involves making services more accessible, faster, and more reliable, thereby increasing customer satisfaction and loyalty. The team approaches these changes as opportunities for broader improvements. Incorporating change management strategies and engaging in co-creation with stakeholders ensure that transformations are smooth and effective. And this is exactly what truly sets our Pragmatic Advisory & Implementation approach apart is our deep integration with client teams. “‘I didn’t know you were an external party’ is a compliment we often hear,” says Stéphanie Struelens. “We become part of the internal team, sometimes even working operationally alongside them. This integration allows us to understand the organization intimately, ensuring our advice is both relevant and sustainable.” Inne Vermeiren highlights another key benefit: “When people see that we genuinely consider their needs, their motivation to embrace change increases significantly”.

Guiding a transformation from A to Z in a sustainable way, including training internal teams and giving them the reins, is the mission. “Being part of that change is very rewarding,” says Inne Vermeiren. The financial sector, despite its somewhat dusty image, is very much engaged in innovation and digitization. “However, there is still a lot of work to be done, making it even more interesting to work as a consultant.”

'I didn’t know you were an external party’ - is a compliment we often hear.

Stéphanie Struelens - Lead - Pragmatic Advisory & Implemention Financial Institutions

A multidisciplinary team equipped with business expertise

The sustainable nature of our solutions comes also from our knowledge of the banking and insurance business, which brings us close to employees because they feel understood and which enables us to challenge and act as a soundboard. When you feel understood, you're less likely to be resistant to change.

“What distinguishes us is that we’ve all had operational experience at a bank or an insurer. We not only have the methodological knowledge necessary to lead a project from the design phase to its execution, but we can also engage with the business and challenge people where needed,” says Stéphanie Struelens. We have the right combination of profiles who together guide our clients toward the best possible solution.”

The team is building upon two decades of experience in pragmatic advisory and is far from starting from scratch. “What also reinforces our business knowledge is that we’re closely working with the Trifinance Transition & Support team who offer flexible & tailor-made operational support and expertise in finance, operations and risk to help banks and insurers facing a transition and in need of solutions,” says Olivier Renard.

What is also part of our DNA is that people working at TriFinance can take ownership of different roles within their current function. “At Trifinance, we believe in nurturing well-rounded expertise within the field of consultancy. Our approach encourages employees to explore diverse roles and engage with various aspects of our service offerings," says Stéphanie Struelens.

Currently, consultant Olivier Renard is facilitating the implementation of a new workflow management platform at a major financial institution, a task he elaborates on as an illustration. “The organization is dismantling several legacy tools,” he says. “But due to the long history, there is some resistance. This involves business analysis, a substantial amount of project management, and the responsibility to guide those people well and gain their trust.” But next to that Olivier is also involved in recruitment and value propositions, and stays up-to-date with the latest technologies, demonstrating that a consultant’s role can be quite comprehensive.

“By allowing individuals to try different hats, they gain a holistic understanding of our operations. This not only fosters co-creation but also enables them to specialize in the direction they want to follow,” concludes Stéphanie Struelens.

Where knowledge transfer and personal growth converge

At TriFinance, we prioritize potential. “As I often emphasize, the essential qualities are soft skills—robustness, cognitive skills, emotional intelligence—a personal connection with our values, and a genuine desire to grow and shape one’s own career. Having at least two years of work experience in operational domains within financial institutions is crucial to understand what is at stake in the sector, but the drive to learn and adapt is paramount,” says Stéphanie Struelens.

“We firmly believe in nurturing talent from the very beginning of everyone’s journey with us,” explains Inne Vermeiren. “A well-thought-out community approach and mentorship are cornerstones of our philosophy. We emphasize learning and sharing knowledge within our communities to broaden knowledge and practices,” says Laura Evenepoel, Care (Human Capital) Manager. “When you join us, you can count on being guided from A to Z in your growth trajectory by knowledgeable people.” This supportive network benefits not only our consultants but also our clients, as it ensures that every consultant enjoys the backing of the entire organization to increase their learning curve.

"Our team members are expected to embody intrapreneurship, and in turn, we act as sparring partners, we advise and guide people in reaching their goals and ambitions throughout their career journey at TriFinance. This commitment aligns with our motto, 'Furthering people for better performance'," says Laura Evenepoel, who highlights the importance of aligning personal development with organizational goals. By fostering a culture of continuous learning and shared expertise, we ensure that our consultants have a broad framework to guide them in their choices and ensure their growth together.

Picture : Pexels

Related content

-

Blog

#takeaways Risk webinar 4: How internal audit contributes to continuous control monitoring

-

Reference case

Building a roadmap to e-invoicing compliance at a clean-energy provider

-

Blog

#takeaways ESG webinar 10: ESG data management, a practical example for first time adopters

-

Blog

#takeaways Risk Round Table: How to enhance organizational preparedness to mitigate emerging risks

-

Reference case

From process optimization to Treasury expertise: a Project consultant's journey through a critical transition

-

Reference case

Documenting Internal Controls for Korean SOX: a pragmatic approach to overcoming resistance

-

Career as Consultant

Senior performance management consultant

-

Career as Consultant

Operations consultant - Insurance

-

Career as Consultant

Data Analyst - Banking/Insurance

-

Career as Consultant

Operations consultant - Banking

-

Career as Consultant

ESG consultant - Banking/Insurance

-

Career as Consultant

Risk Management consultant - Banking/Insurance