- Quality & reliability of ESG data will be crucial for your CSRD reporting

- Strive for integrated data infrastructure to centralize all relevant data

- Company size and current data maturity impact the solutions for your organization

- The advantages of EPM solutions vs Excel

In the coming years, ESG compliance will have a significant impact on the sustainability landscape. To assist organizations in addressing these challenges and requirements, TriFinance is organizing a series of webinars on related topics to share meaningful insights and best practices.

The tenth webinar, 'ESG data management, a practical example for first time adopters’ featured insights from TriFinance experts Maarten Lauwaert, Sophie Van Lier and Susan De Boever, who shared their knowledge about the ESG data landscape with participants from various companies. They discussed how companies can capture and store ESG data, based upon the company’s strategy and objectives. A demo of Vena Solutions showed a practical example for first time adopters. Gaëlle De Baeck, Sustainability Lead at TriFinance, hosted the session.

Data Management in your CSRD sustainability journey

We see six pragmatic steps as a best practice in your CSRD sustainability journey. In this webinar, we zoom in on step five: define detailed business requirements for the data management model & roll out the implementation with regards to data-gathering, data-input, consolidation of the data and output reports (KPI & metrics).

Companies must report on a substantial volume of data points, with a maximum of1134. There are different kind of data points:

- Numerical (30%) = monetary values, volumes, percentages, decimal and more

- Semi-narrative (13%) = data types used to enrich narrative disclosures (yes/no, lists, summary and more)

- Narrative (57%) = text blocks.

For a breakdown of all data types per ESRS, we advise you to download the EFRAG spreadsheet here.

The importance of ESG data goes beyond regulatory compliance. Think about enhanced reporting, meeting stakeholder expectations as there is a growing interest in non-financial data and overall transparency and risk management as informed decision making needs reliable data. Furthermore, efficient data management systems can facilitate day-to-day operations and strategic decision making in the long run.

High-quality ESG data and an integrated infrastructure are essential for CSRD reporting, and as companies grow, transitioning from Excel to EPM tools like Vena Solutions can enhance accuracy and efficiency.

Susan De Boever

How to capture ESG data

There are specific needs for ESG reporting. Think about the different types of data, complex calculations (e.g. carbon emission), combination of new and existing data, integrations with multiple source systems, … to name a few.

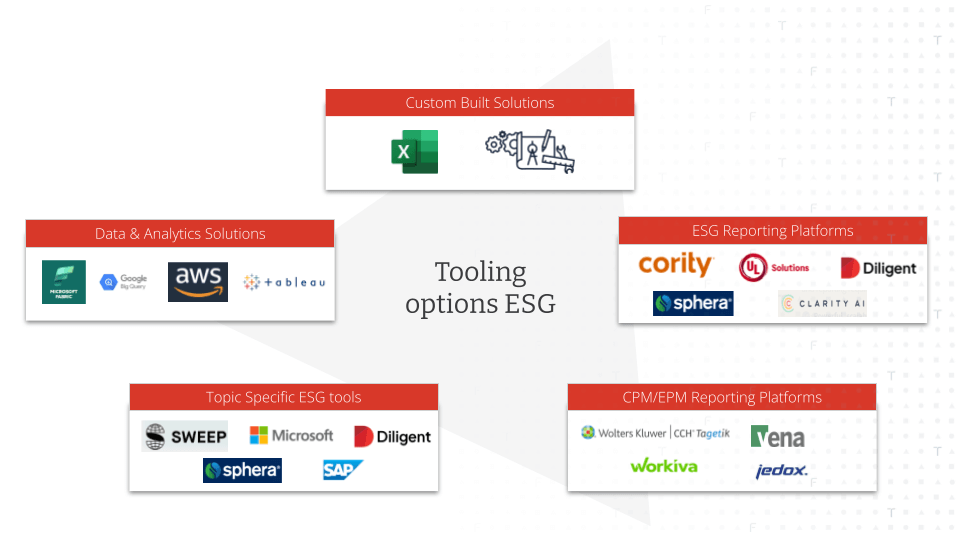

Different solutions can help to facilitate the ESG reporting process. We see 5 solution types to capture ESG data, including pros and cons:

- Excel or custom built solutions - tailored to your needs, yet high maintenance, scalability is limited and implementation can be very expensive.

- ESG reporting platforms (Examples: Diligent, UL Solutions, Sphera, Cority, Clarity AI… (Verdantix Green Quadrant) - for more complex organizations, designed for ESG reporting, yet can be expensive due to licenses and often external support needed and often financials are not included.

- CPM / EPM Reporting Platforms (Examples: Tagetik, Workiva, Jedox, Vena, ... ) - for more complex organizations, can be extension if CPM / EPM is already used for FP&A or Consolidation, yet can be expensive due to licenses and often external support needed.

- Topic specific ESG tools (Examples: Microsoft cloud for sustainability, SAP Sustainability footprint mgt, Salesforce Net zero cloud, Sweep, Sphera, … (Verdantix Green Quadrant carbon management) - for specific ESG process or data, f.e. DMA analysis, carbon emission calculation, carbon accounting, Taxonomy, …., yet can be expensive due to licenses and often external support needed, need for integrations with other tooling and you are dependent on the roadmap of these specific solutions.

- Data & Analytics solutions (Examples: Microsoft Fabric/Synapse Analytics, Google BigQuery, Amazon AWS, Power BI, Tableau,...) - Central data layer; Reporting tools can be used to report on all sorts of data, incl. ESG related data, yet can be expensive due to licenses and often external support needed, a higher data maturity level needed and this approach is always a partial solution as other solutions will be needed to cover the full reporting scope.

Typically, when more people are getting involved and the complexity increases, we see Excel has its limitations.

Maarten Lauwaert

From Excel to Enterprise Performance Management (EPM) tool

Excel is often a good starting point for many organizations, both small and big, to set up their ESG reporting. The ease of use, flexibility, limited cost and customizations are elements that show the advantages of Excel. Typically, when more people are getting involved and the complexity increases, we see Excel has its limitations.

It’s worthwhile to investigate the option of an EPM tool as they often have an Excel front end available. This way you can easily get familiar with a new solution while taking advantage of your knowledge of Excel.

A practical example of ESG data management in Vena Solutions

Although TriFinance is tool-agnostic by design, our EPM and ESG experts believe Vena Solutions is an accessible solution. The tool is built on Microsoft technology and combines the flexibility of Excel, with a cloud-based collaboration platform. Other advantages include:

- User friendly system: excel interface

- Capture data manually & via integrations

- Combine ESG data with financial data and operational data

- Support collaboration via workflows & collaboration platform

- Ensure data quality & security via audit trails

Demo Vena Solutions

During the webinar we shared a practical example of ESG data management in Vena Solutions. If you are interested in a demo session for your organization, please contact us via epm@trifinance.be.

In conclusion, your data collection approach for CSRD reporting will become very important in the coming years. Take into consideration how your recurrent reporting landscape can contribute to the CSRD reporting needs, yet strive for an integrated data infrastructure to centralize all relevant data. The quality and reliability of ESG data will be crucial for your CSRD reporting.

During this tenth TriFinance ESG webinar we provided an overview of the different solutions to capture and store ESG data. Each solution has its pros and cons, which vary depending on the size, complexity, and requirements of the organization. We shared the advantages and disadvantages of Excel vs an EPM solution. Vena Solutions could be an option for your organization as it combines the strengths of Excel with the advantages of an EPM tool.

Related content

-

Blog

Overcoming key hurdles in Finance Transformation: a guide for CFOs and Finance teams

-

Reference case

Contributing to finance transformation at VF Europe with temporary bookkeeping support

-

Reference case

Transforming Finance in EMEA for a specialty chemicals company

-

Blog

Improving efficiency and strategic alignment at an Investment Company

-

Blog

How to leverage AI in finance processes to improve forward-looking insights

-

Blog

Europe’s green deal turns pale