E-Invoicing

Your challenges

- Manage compliance with varying e-invoicing regulation

- Align tool integration with existing systems

- Review all relevant data points concerning e-invoicing

Driven by the January 1, 2026 Belgian deadline, e-invoicing often begins as a compliance requirement. However, you could also view e-invoicing as a chance to optimize business processes and implement value-adding tools. Many organizations just prepare for compliance or look to tools as a quick fix, but e-invoicing requires a broader, more integrated approach. That's where we come in.

TriFinance E-Invoicing Expert Desk

Book your free one-on-one call with one of our expertsMany companies are still struggling with e-invoicing. They don’t know how to get started, raise internal awareness, or select the right tools. Often, they focus only on technology and overlook the impact on people and processes.

Do you have questions such as:

- How can we select the right access point or tool for our organization?

- What about conventional streams (PDF/paper) vs. e-invoicing? How do we handle both streams?

- Which master data is necessary for e-invoicing?

Our E-Invoicing Expert Desk is ready to help you address these complexities. Click the button above to ask your question and book a free one-on-one session with one of our experts today. We’ll offer practical and technical advice to ensure you make the most of e-invoicing.

Are you ready for e-invoicing D-Day?

New e-invoicing legislation is being enforced worldwide, with Belgium's deadline set for January 1st, 2026. Are you prepared for the upcoming e-invoicing regulations affecting your company?

If your organization relies on traditional methods such as receiving AP invoices via PDF or mail, handling AR invoices through paper or PDF, and lacks the necessary tools for P2P or O2C processes, it's likely that you're not yet using e-invoicing. And even if you are, did you develop a global roll-out plan related to e-invoicing for your compliance scope, regarding all your legal entities?

E-Invoicing: From Compliance to Opportunity

Getting compliant with e-invoicing legislation is essential, but it doesn’t have to stop there. Preparation for the various new e-invoicing legislations can be a catalyst for both process and tool improvement within Purchase-to-Pay and Order-to-Cash.

A holistic, integrated approach, can help you turn e-invoicing compliance into a chance to optimize your processes and adopt value-adding tools. Whether dealing with AP/AR invoices, managing multiple invoicing sources, or ensuring Peppol compatibility, it is crucial to streamline your processes for greater efficiency and compliance.

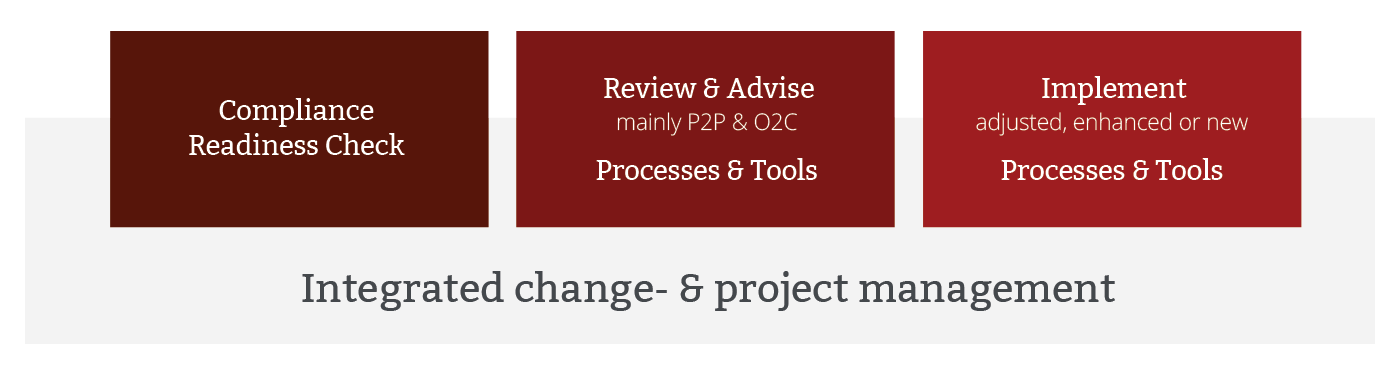

Whether you need pure compliance support or a broader transformation, this is what we can offer you:

- Compliance readiness check

How prepared is your organization for e-invoicing compliance? Our readiness check evaluates your business processes (P2P and O2C), master data, and relevant applications against current and upcoming compliance requirements. We provide tailored recommendations, taking into consideration crucial factors such as geographical compliance insights, processes, and tools to help you move forward. - Processes & tools review and implementation

E-invoicing legislation affects processes, people and tools, presenting an opportunity for improvement. Our integrated approach goes beyond basic compliance. We address compliance within your organization’s ecosystem of people, processes, and tools. Taking your unique geographical context, strategy and compliance needs into consideration, we provide independent support to assess, select and implement the tools that best align with your requirements.

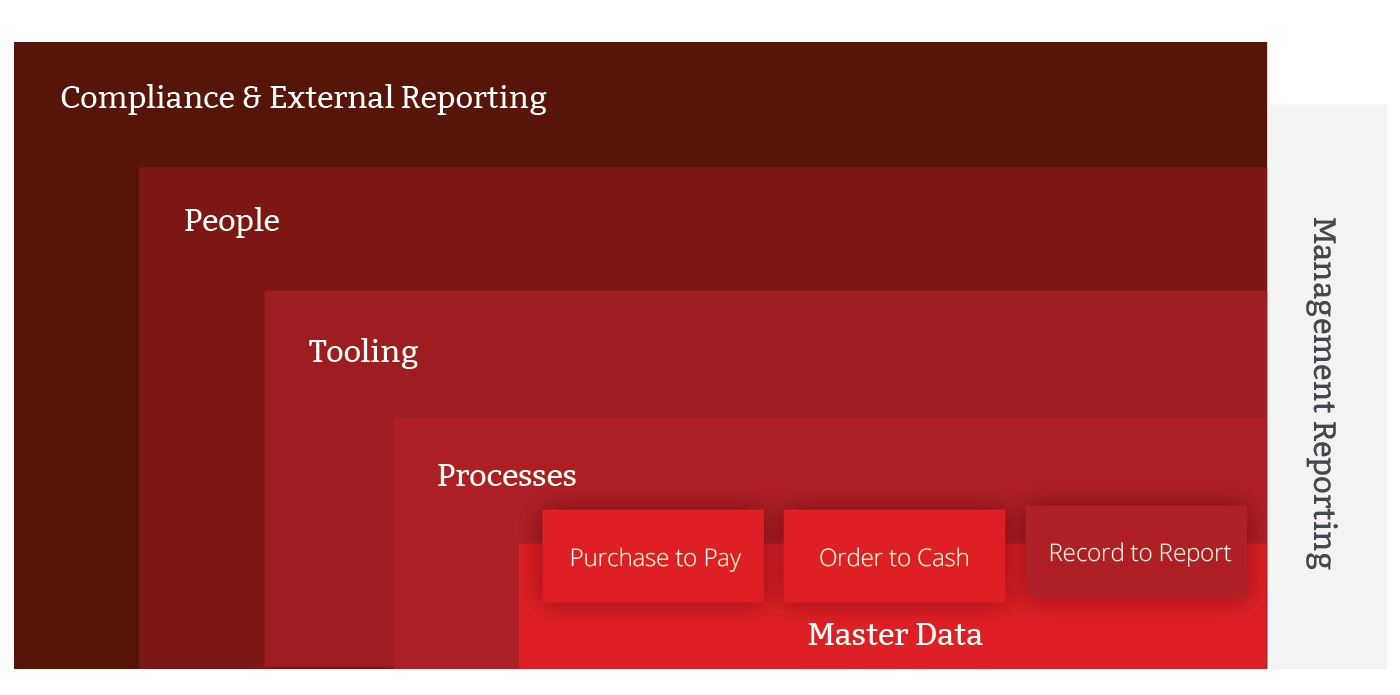

E-Invoicing key building blocks

TriFinance employs a clear framework of key building blocks to ensure e-invoicing compliance while improving your organization's processes.

- E-Invoicing compliance scope: Definition of the geographical scope of e-invoicing legislation.

- Process, master data & tool review: Review of current processes, master data and tools related to e-invoicing. We identify necessary adjustments.

- Process assessment & improvement: We evaluate existing processes, design improved ones, identify gaps, implement quick wins, and present an enhancement roadmap.

- Tool selection & implementation:

- Assessment: We review current tools and processes.

- Solution design: We assess current and future needs, align invoice requirements with vendors and customers, and translate these into functional requirements

- Tool selection: Based on client requirements, we start a Request for Proposal Process. We evaluate bidders through demos, and make recommendation for the tool

- Implementation: We draft a project plan, manage the rollout, create and execute test scenarios, and integrate tools with processes.

Create overall E-invoicing awareness: Our project approach always considers the awareness across your organization about e-invoicing.

Turning compliance into opportunity

E-invoicing is more than meeting regulations — it drives efficiency. Optimize processes, enhance tools, and align compliance with your goals to reduce costs, minimize errors, and improve cash flow. Expert support ensures effective solutions and long-term success.

- Get compliant with upcoming requirements.

- Optimize your processes by aligning compliance, tools, and people.

- Use new legislation to improve processes and tools, gaining a head start on e-reporting.

- Get higher cost efficiency by reducing manual invoice processing and errors in the Procure-to-Pay (P2P) process, as well as by improving cash collections in the Order-to-Cash (O2C) process.

- Leverage TriFinance expertise for unbiased tool selection, process improvements, and change management.

TriFinance employs a clear framework of key building blocks to ensure e-invoicing compliance while improving your organization's processes.

Who will support you?

Our specific subject-matter expertise, industry knowledge and pragmatic advisory methodologies are delivered by CFO Services

Related content

-

Article

#Takeaways e-invoicing webinar 1: E-Invoicing beyond compliance

-

Event

E-Invoicing webinar: countdown to 2026 compliance

-

Article

The key to Finance Transformation: Simplicity and agility. A roundtable with TriFinance experts

-

Blog

Overcoming key hurdles in Finance Transformation: a guide for CFOs and Finance teams

-

Reference case

Contributing to finance transformation at VF Europe with temporary bookkeeping support

-

Reference case

Transforming Finance in EMEA for a specialty chemicals company

-

Career in Internal Team

Client Partner | Public Sector

-

Career as Consultant

Senior Finance consultant | Public sector

-

Career as Consultant

Junior Finance Consultant | Public Sector

-

Career as Consultant

Medior Finance Consultant | Public Sector

-

Career in Internal Team

Insurance expert manager

-

Career as Consultant

Young Graduate | Trainee Program