Transforming the finance function: How finance drives value beyond numbers

27 February 2025Continuous transformation is the new normal, also for the finance function. Today, the finance department is no longer just an organization’s financial steward responsible for financial reporting and accounting, budgeting, cost management, cash flow management, audit or compliance. Instead, the finance department has become a strategic value creator who helps set the direction as a true business partner.

This allows organizations to stay ahead in times of uncertainty, inflation and constant change. Thus, the role of the CFO (Chief Financial Officer) shifts to CVO (Chief Value Officer), driving value creation beyond just financial metrics.

- Finance’s growing role: Finance has developed into a strategic business enabler that is crucial in decision-making, aligning financial priorities with business goals, and driving innovation and transformation.

- Core pillars of a transformed finance function: Operational excellence, strategic influence, and value generation are essential for a transformed finance function.

- Key drivers: Digital disruption, increasing regulatory compliance & focus on ESG and the rapid evolution of financial technology are driving finance transformation.

- Need for new skills and capabilities within finance teams: Besides strong digital, strategic, and soft skills, finance professionals need to develop non-financial performance measurement skills.

- The transition from CFO to CVO: The highest level of finance transformation is represented by the shift from Chief Financial Officer to Chief Value Officer, who serves as a strategic partner to the CEO and board and focuses on generating quantifiable value beyond financial measurements.

The finance department’s expanding role in the organization

The role of finance has grown far beyond its traditional boundaries. Bookkeeping, reporting and compliance are still part of the core responsibilities, but the role of the finance function in an organization has drastically expanded in scope and strategic importance. From a reactive scorekeeper, the finance function has evolved into a proactive business enabler whose mission it is to support enterprise-wide decision-making, align financial priorities with business objectives and drive innovation and transformation. What exactly does this mean?

Supporting enterprise-wide strategy and decision-making

By providing real-time analytics and insights, finance professionals can help organizations in making well considered decisions, navigating the ever-changing market conditions. Furthermore, advanced and predictive data analytics allow for analyzing market trends and identifying growth opportunities or risks. The finance function thus becomes a pivotal player in steering business decisions and strategy.

“Providing the right insights and drawing conclusions that actually improve business performance is actually one of the core tasks of the finance role”, states Vicky Posthumus - Expert Practice Leader Finance Transformation. “Another core task is ensuring that the organization’s people, processes and systems are continuously optimized. Can any tasks be eliminated? What can be automated? And what will it take? These questions are integral to the scope of the finance function.”

Aligning business objectives with financial priorities

To truly deliver on its expanding scope, the finance role must bridge the gap between financial goals and broader business objectives. As such, cost-reduction exercises should not come at the expense of future growth. The finance team should be able to take a broad perspective on value within the organization.

This requires understanding the core drivers of value creation and aligning financial priorities with the organization’s mission. For example, in organizations that prioritize sustainability, the finance function plays an important role in prioritizing investments in renewable energy projects and evaluating their return on investment (ROI) using both financial and environmental indicators.

Driving innovation and transformation

Automation tools allow to streamline repetitive tasks such as accounts payable processing, freeing up time for finance professionals to focus on strategic initiatives. Furthermore, implementing predictive analytics tools allows finance to forecast trends more accurately and identify risks before they materialize.

Building on their experience in adopting new technologies and optimizing processes to deliver greater organizational value, the finance role is increasingly coming to the forefront of general organizational transformation. Finance is thus taking on the role of transformation manager, enabling change beyond the finance department, or even initiating and leading the transformation.

“By integrating artificial intelligence (AI) into their forecasting models, finance teams can anticipate changes in customer demand and enable more agile decision-making. This transformation redefines the finance operating model, positioning it as an engine for innovation and competitive advantage for the whole organization”, explains Johan Reunis, Expert Practice Lead ERP Business Integration.

You cannot complete a transformation journey on the assumption that you don’t need to change anything after that. Continuous, incremental transformation is better than a one-time ‘Big Bang’ change.

Vicky Posthumus, Expert Practice Lead Finance Transformation

Core pillars of a transformed finance function

To be successful in its new role, finance teams must reinvent themselves and master new finance skills. A fully transformed finance function is built on these three core pillars:

Operational excellence: process optimization and efficiency

Operational excellence through process optimization is a key aspect of transforming the finance function. It involves streamlining workflows, eliminating inefficiencies and developing more consistent and productive ways of working within finance teams.

This focus on continuous improvement allows to deliver higher-quality outputs, respond more rapidly to organizational needs, and invest more in strategic and value-adding activities.

Strategic influence: business partnering and advisory roles

Moving away from the purely administrative and compliance role of finance towards a role as strategic advisor, finance professionals need to invest in building strong stakeholder relationships within the whole organization and with the outside world.

Partnering with other departments, the board, the shareholders and other external parties, they are able to guide decision-making through data-driven insights and play a crucial role in the organization by identifying new opportunities, mitigating risks and proactively co-creating solutions to address challenges.

Value generation: aligning with organizational purpose

The transformed finance function’s ultimate goal is to generate value beyond financial metrics. To do so, it needs to focus on a diversity of value drivers, from operational (e.g. operational efficiency, product and service offerings and innovation, economies of scale) over human capital and strategic to non-financial value drivers such as sustainability and corporate culture.

Transformation is not a one-time event, emphasizes Vicky Posthumus, Expert Practice Lead Finance Transformation.

“Organizations in general and finance departments in particular must adopt a mode of continuous transformation. You cannot complete a transformation journey on the assumption that you don’t need to change anything after that. Continuous, incremental transformation is better than a one-time ‘Big Bang’ change. Each team member has a responsibility to identify possible improvements every day. This is the way to future-proof your finance function.”

Finance transformation is not just about adopting new processes and tools; it’s about reimagining how the function delivers value.

Alexander Declerck, BCB Leader Transition & Support

Key drivers of finance function transformation

Achieving such a finance transformation requires significant investments. Not simply monetarily, but also in terms of change management: reskilling finance employees and keeping teams motivated.

Standing still is no longer an option, for a number of reasons:

Digital disruption and the increased demand for real-time insights and advanced analytics

Real-time insights and detailed & sophisticated analytics are prerequisite for success in today’s fast-paced world. Finance processes and financial reporting should run seamlessly to facilitate this.

Therefore, finance departments must embrace new technologies. Think of how a fast and accurate processing and analysis of large volumes of data allows for real-time reporting and scenario analysis, or how it enables accurate predictive analytics.

This is where technologies such as advanced analytics and AI in finance play a crucial role.

Additional legislation and compliance

While traditionally the finance function has been responsible for regulatory compliance, its importance is ever increasing. As regulatory pressure continues to grow, finance departments can benefit from robust compliance frameworks supported by technology. This allows them to ensure compliance with complex regulations, minimize risks associated with non-compliance and stay ahead of rapidly evolving regulations.

Increased focus on sustainability and ESG integration

Sustainability and ESG represent a specific use-case of how the finance department can take a driving role in compliance with new legislation and achieving organization-wide sustainability goals. With finance's expertise in capturing, consolidating and reporting numbers, the finance department is the go-to to ensure compliance with new legislation such as CSRD (Corporate Sustainability Reporting Directive). At the same time, as a true business partner, the finance function has the authority to move beyond ESG compliance and establish sustainability as a strategic value creator.

Emerging new (fin) tech

The speedy evolution of technology in the financial industry is a key driver and enabler for finance transformation. It has opened up a world of faster and more accurate transaction processing, enhanced data security and transparency, and non-negligible opportunities for greater collaboration and integration across departments.

When rolling out a Target Operating Model, you cannot underestimate the people aspect and should monitor the impact of transformation on the skill set of both individuals and the entire team.

Alexander Declerck, BCB Leader Transition & Support

Skills and capabilities for the future finance team

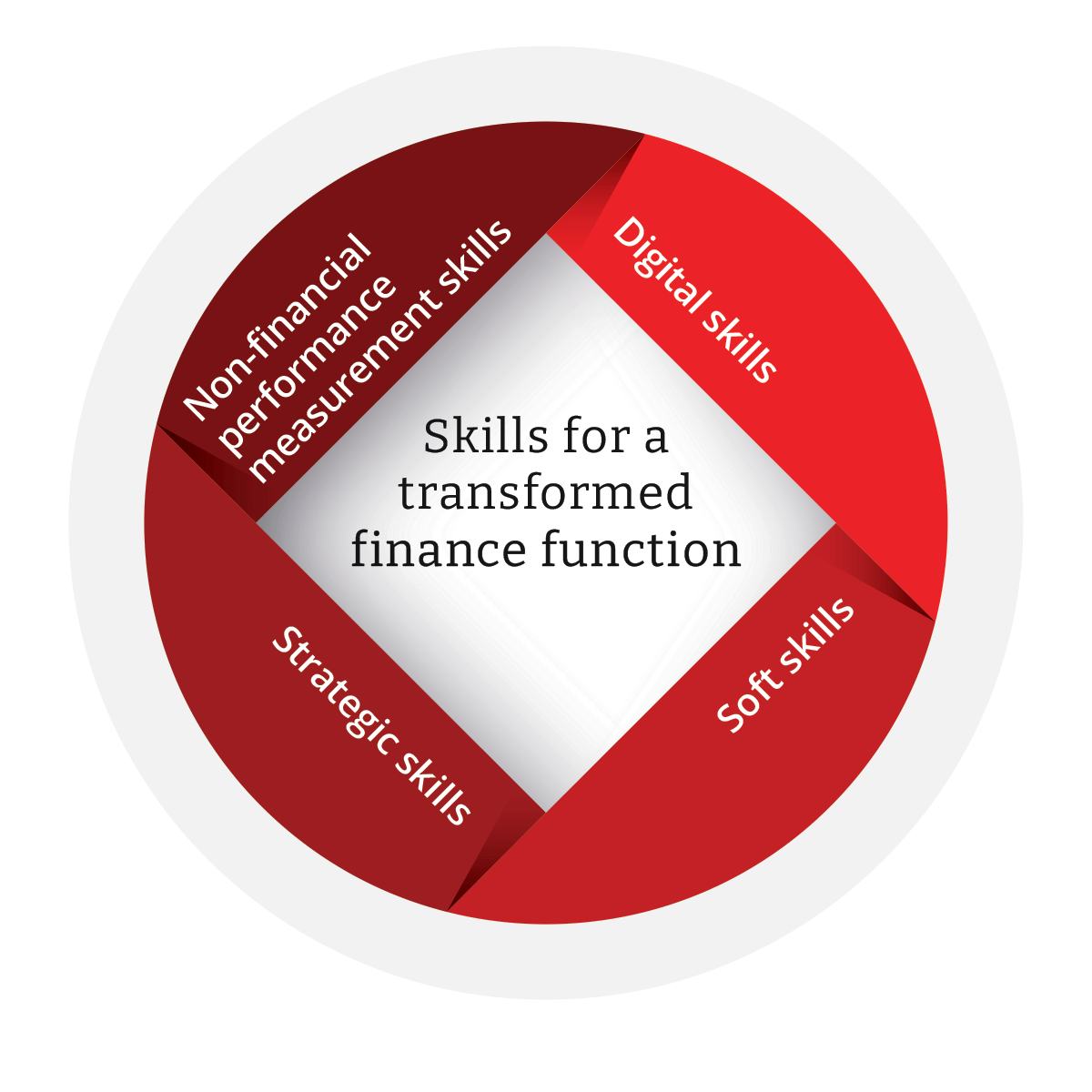

As finance professionals move beyond their administrative role and become co-value drivers, they also need to expand their finance skills and develop a broader skillset, combining digital, soft, strategic and non-financial performance measurement skills.

Digital skills

Continuous adaptability and lifelong learning are indispensable for any professional today. For finance teams, this means staying up to date in data analytics, AI, and digital tools.

Soft skills

Finance specialists must be able to not only deliver the appropriate figures, but also convey their ideas to non-finance colleagues in a straightforward and convincing manner. As a result, cross-functional teamwork and stakeholder management skills, as well as communication and leadership, are critical.

Strategic skills

To contribute maximum value, it is necessary to know the business inside out and follow market trends to identify possible opportunities and innovations. Business acumen is key.

Non-financial performance measurement skills

Finance teams even need to expand their skill sets beyond typical financial expertise, to include capabilities for measuring non-financial performance. This shift is especially noticeable in ESG reporting, where there is a need to map, measure and improve carbon footprint or energy usage. However, measuring business performance beyond financial metrics also requires new capabilities in terms of qualitative analysis and holistic performance evaluation

By upgrading their skillset beyond understanding balance sheets, cash flow statements and P&L’s, finance teams are better positioned to play a crucial role in strategic choices, innovative initiatives and operational excellence inside their organization. Of course, not every finance professional will be equally capable in all of these areas. The goal should be to build a balanced finance team with complementary specializations.

“A CFO or finance transformation manager has an essential role to play as a people and finance manager”, says Alexander Declerck, BCB Leader Transition & Support. “When rolling out a Target Operating Model, you cannot underestimate the people aspect and should monitor the impact of transformation on the skill set of both individuals and the entire team. Not every finance professional has the ambition to become a controller. You need to fully understand the strengths and ambitions of each team member, and be able to guide them in terms of mentoring, coaching, and formal training.”

CVOs elevate their role beyond financial performance to become true orchestrators of value.

Stéphanie Struelens, Pragmatic Advisory and Implementation Lead for Financial Institutions

Evolving from CFOs to CVOs

The transition from CFO (Chief Financial Officer) to CVO (Chief Value Officer) is the pinnacle of the finance function transformation. A CVO can claim the new title after succeeding as finance transformation manager and leading the finance team towards their new role as strategic value driver.

A CVO stands out from a CFO by focusing on creating measurable value beyond financial metrics and acting as a strategic business partner to the CEO and the board.

“CVOs elevate their role beyond financial performance to become true orchestrators of value—transforming data into actionable insights, managing uncertainty due to an increasing number of business drivers and taking sustainable decisions in line with the organization's purpose”, concludes Stéphanie Struelens, Pragmatic Advisory and Implementation Lead for Financial Institutions.

How TriFinance can help to successfully transform your finance department into a strategic value creator

In summary, finance transformation turns the finance function into a trusted business partner, ensuring continuous improvement and agility. By combining solid expertise in advanced technology, process optimization, and innovative organizational design, TriFinance can support the transformation of your finance department. We have the right people and systems to drive efficiency and data-driven decision-making.

During transformations, our flexible external workforce helps drive operational efficiencies, ensuring continuity. TriFinance consultants bring scalability, expertise, and fresh perspectives. They help clients address transformation challenges efficiently.

Our approach helps companies stay competitive and ready for sustainable growth.

Related content

-

Blog

Kristien Schreurs: Building a high-performing sustainability team

-

Blog

Overcoming key hurdles in Finance Transformation: a guide for CFOs and Finance teams

-

Reference case

Contributing to finance transformation at VF Europe with temporary bookkeeping support

-

Reference case

Transforming Finance in EMEA for a specialty chemicals company

-

Blog

Improving efficiency and strategic alignment at an Investment Company

-

Blog

How to leverage AI in finance processes to improve forward-looking insights

-

Career in Internal Team

Client Partner | Public Sector

-

Career as Consultant

Senior Finance consultant | Public sector

-

Career as Consultant

Junior Finance Consultant | Public Sector

-

Career as Consultant

Medior Finance Consultant | Public Sector

-

Career in Internal Team

Insurance expert manager

-

Career as Consultant

Young Graduate | Trainee Program