- Take into consideration the entire value chain for identification of potential topics and related stakeholders

- Involve your board of directors/management

- Use the DMA as a starting point for your sustainability strategy

In the coming years, the sustainability landscape will be significantly impacted by ESG compliance. To assist organizations in addressing these challenges and requirements, TriFinance is organizing a series of webinars on related topics to share meaningful insights and best practices.

The third webinar,’How to prepare your Double Materiality Assessment for CSRD compliance’ featured insights from TriFinance experts Mario Matthys and Susan De Boever, who shared their knowledge with participants from various companies. They discussed the pragmatic roadmap of the DMA, which is the first step to CSRD compliance, where your material ESG topics will be identified. Moreover they gave practical insights and best practices in developing this double materiality assessment. Gaëlle De Baeck, Sustainability Lead at TriFinance, hosted the session.

Structure of the European Sustainability Reporting Standards (ESRS)

The new reporting standards are applicable to all companies, yet they differ depending on the sector of the company. Additional sector-agnostic disclosures are based on materiality assessment and are applied to all sectors equally. Sector-agnostic items are mandatory but subject to a Double Materiality Assessment.

The Double Materiality Assessment is mandatory for companies reporting under CSRD (ESRS 1) and identifies material sustainability topics and determines the minimum scope of the sustainability reporting for your company. ‘Double’ is linked to the two perspectives to keep in mind when thinking about a sustainability item:

- Impact materiality (Inside-out impact): organization’s impact on planet & society

- Financial materiality (Outside-in impact): planet & society impacts on the organization (Risk & opportunities)

In the audit quest for assurance, the DMA memo is your vital compass, capturing decisions, steps, and analyses, ensuring a confident and precise course.

Susan De Boever

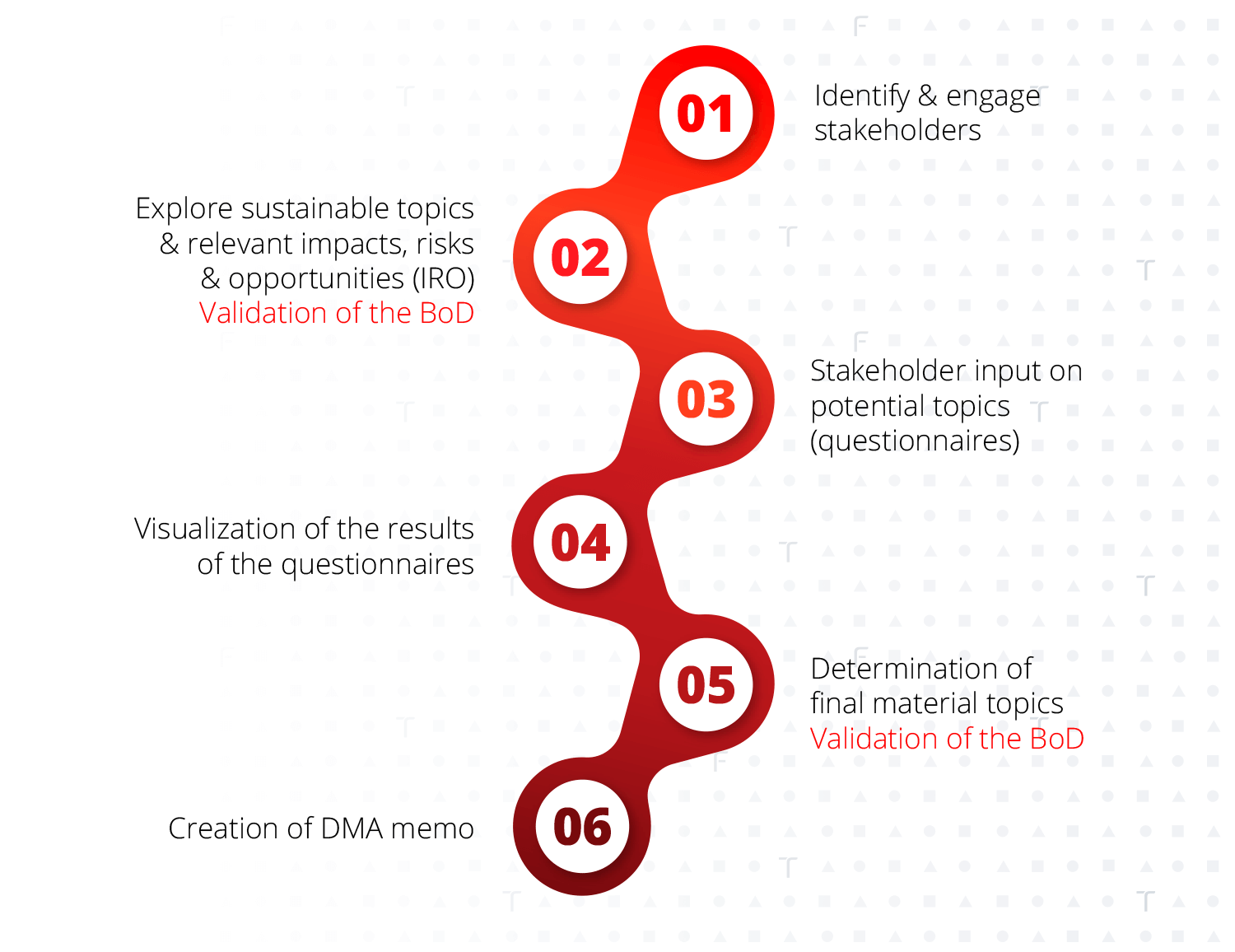

Zoom on the Double Materiality process

When executing the Double Materiality Assessment, keep the following steps in mind:

- Identify and engage stakeholders. Identify key stakeholders, both internal & external, impacted by & affected by the organization. Classify stakeholders to assess which ones have the most significant influence/dependence.

- Explore sustainable topics & relevant impacts, risks & opportunities (IRO). Potential topics based on sector benchmarking/peer analysis and create a preliminary list of IROs. Set up cross checks with different competitors and peers of the organization, link with ESRS 1, based on sector knowledge and stakeholder engagement define a preliminary overview of IROs.

- Stakeholder input on potential topics (questionnaires). Engage stakeholders (both internal and external) in assessing the impact (both financial and impact) of the potential topics from step 2. Establish an engagement strategy aligned with the company’s preference and to get an idea of the importance of the topics, financial and impact materiality will be assessed.

- Visualization of results of the questionnaires. The outcome of the stakeholder enquiry is analyzed and structured showing which topics are the most relevant per stakeholder category and for the whole organization. You do this by consolidating and structuring all the inputs; the importance of the potential topics will be visualized in a heatmap. A company defined threshold will serve as a first suggestion of material topics.

- Determination of final material topics. The results of the questionnaires and heatmap will be validated by the board. The board will assess the results of the questionnaires and appropriate quantitative/qualitative thresholds will be defined in order to assess the materiality. The board will take into consideration other inputs: severity (scale, scope, irreversibility) and likelihood.

- Creation of DMA memo. A DMA memo will be prepared, which will encompass the methodology employed, the calculations made, and the conclusions drawn from the DMA analysis. The DMA memo will also serve as an input for the disclosure requirements (see ESRS 1 chapter 3 and ESRS 2 IRO-1).

Board and stakeholder engagement are key. Their level of awareness will determine the success of the DMA exercise.

Mario Matthys

In conclusion, the key message of this TriFinance ESG webinar is that sustainability goes beyond mere reporting, it is an opportunity to strengthen your corporate image. Do not see the Double Materiality Assessment as a mandatory assignment, but as a starting point of your sustainability strategy. Keep in mind the entire value chain of your company and involve the board in the entire process to create maximum impact. Lastly, we advise you to start well in advance as the lead time can take more time than expected.

Related content

-

Reference case

Setting credit limits at a Belgian industrial

-

Blog

Kristien Schreurs: Building a high-performing sustainability team

-

Blog

Overcoming key hurdles in Finance Transformation: a guide for CFOs and Finance teams

-

Reference case

Contributing to finance transformation at VF Europe with temporary bookkeeping support

-

Reference case

Transforming Finance in EMEA for a specialty chemicals company

-

Blog

Improving efficiency and strategic alignment at an Investment Company

-

Career in Internal Team

Client Partner | Public Sector

-

Career as Consultant

Senior Finance consultant | Public sector

-

Career as Consultant

Junior Finance Consultant | Public Sector

-

Career as Consultant

Medior Finance Consultant | Public Sector

-

Career in Internal Team

Insurance expert manager

-

Career as Consultant

Young Graduate | Trainee Program