How CCH® Tagetik compares to common alternatives

Challenges

- Streamline data integration and validation

- Ensure compliance with accounting standards and regulations

- Enhance budgeting and forecasting with advanced analytics and modeling

TriFinance is tool-agnostic by design, meaning we always focus on finding the best solutions for our client's specific needs. However, for Enterprise Performance Management (EPM), we have a strategic partnership with CCH® Tagetik because we believe in the platform’s comprehensive approach to financial and operational performance management.

Comparing CCH Tagetik with other EPM tools to find the right fit

CCH® Tagetik offers unparalleled strengths in financial close and consolidation, ESG & Regulatory, Corporate Tax, and Extended Planning. It enables businesses to streamline financial processes, from budgeting and forecasting to performance reporting and disclosure management, with built-in financial intelligence. Its robust data integration capabilities also include seamless connections with ERP applications such as SAP 4 HANA and BI tools such as Power BI. A flexible deployment model (cloud or on-premise), allows companies to unify data and gain real-time insights. The user interface of CCH® Tagetik can be web-based or fully integrated with Microsoft Office via Excel, Word, and PowerPoint Add-in functionality.

By partnering with CCH® Tagetik, we help our clients:

- Automate financial consolidation to speed up the closing process and reduce manual effort.

- Ensure compliance with IFRS, GAAP, CSRD, and other regulatory standards through automated reporting and audit trails.

- Speed up the budget and forecast process using driver-based planning practices, multiple version management tracking changes during the process, and integrated world and process flow.

- Improve decision-making with advanced reporting and analytics, including integrated dashboards for clear, actionable insights.

While we value the comprehensive features of CCH® Tagetik, we remain dedicated to exploring the full range of EPM alternatives to ensure our clients find the perfect solution for their specific needs. This page provides a comparison of CCH® Tagetik with other popular EPM solutions, helping you make an informed decision based on your organization’s unique requirements.

With more time available for in-depth analysis, decision-makers can focus on identifying growth opportunities, managing risks, and driving value for the organization. At TriFinance, we assist companies in choosing the application that best aligns with their goals and requirements.

Stéphanie Struelens, Lead Pragmatic Advisory & Implementation TriFinance Financial Institutions

Why CCH® Tagetik?

Any company looking for an integrated solution for their financial consolidation, planning, reporting, and regulatory compliance should consider CCH Tagetik. With its strengths in the area of financial consolidation, its regulatory templates, and strong planning capabilities, Tagetik provides many advantages to companies with complex financial and operational processes or industry-specific regulatory requirements. Additionally, its scalability, flexibility in deployment, and ease of integration with existing source systems make it a robust solution for enterprises looking to streamline and automate their financial and operational processes.

Key capabilities and differentiators of CCH® Tagetik

The following capabilities truly differentiate CCH® Tagetik from alternative EPM solutions:

CCH Tagetik is a unified platform that integrates all financial and non-financial processes, improving data accuracy and consistency. Compared to the common alternatives mentioned above, it has the following advantages.

- Tagetik Consolidation: More precise and timely financial statements that comply with regulatory standards, such as IFRS.

- Tagetik Budgeting: Advanced budgeting functionalities that enhance efficiency and accuracy in the budgeting process.

- Tagetik Planning and Forecasting: Real-time data integration for responsive and accurate planning and forecasting.

- Tagetik Reporting: Simplified financial consolidation and compliance through comprehensive reporting capabilities.

- Tagetik Pricing: Adaptable pricing options to suit various organizational needs.

- Tagetik Integration: Easy integration with ERP and BI systems, enhancing data flow and accuracy.

- Tagetik Community: Support, best practices, and resources provided through an active user community.

- Microsoft 365 Integration: Creation of managerial and statutory reports through robust integration with Microsoft 365.

- User-Friendly: Easy adoption by employees through customer-dedicate

Tagetik for integrated EPM Processes

Tagetik is a good fit for companies looking for an EPM tool that manages multiple processes. It is ideal for organizations that seek to integrate different financial processes into one unified platform, ensuring they can have all their relevant data in one.

Three EPM tools compared with CCH® Tagetik

- Board International

Overview:

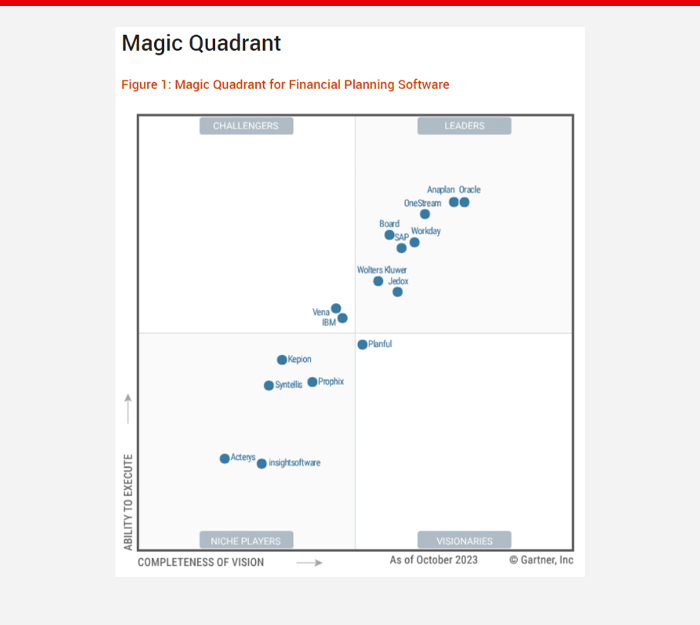

Board International offers an all-in-one decision-making platform that integrates business intelligence (BI), EPM, and analytics. Board International is recognized as a Leader in the Gartner Magic Quadrant for Financial Planning Software and as a Visionary in the Gartner Magic Quadrant for Financial Close and Consolidation Software.

Strengths:

Board International seamlessly combines EPM capabilities with BI features, offering a versatile solution for various corporate functions. Key features include:- Intuitive, customizable interface: The user interface is designed to be highly intuitive and can be easily tailored to specific needs, making it accessible to users at all levels.

- Dynamic Microsoft Office integration: Board integrates in real time with Microsoft Office, keeping data dynamic and up-to-date..

- Effortless model setup for key functions: Budgeting, planning, and reporting models are straightforward to configure—requiring no coding skills.

Limitations:

Using Board for sophisticated budgeting, forecasting, and reporting tasks can require significant effort, particularly in scenarios that demand fully driver-based planning. For example:- Driver-based sales processes: Automatically populate the P&L based on sales drivers.

- Investment and CAPEX planning: Link directly to both balance sheets and P&L statements.

- Workforce Planning: Distribute resources across various cost centers and departments seamlessly.

It’s also worth noting that while Board’s core strengths lie in Business Intelligence (BI), it lacks a dedicated consolidation engine, which can make certain consolidation tasks less straightforward compared to specialized tools. According to BARC, the price-to-value ratio of Board is below average, which is another consideration for stakeholders evaluating return on investment. - Jedox

Overview:

Jedox is a software platform that combines Enterprise Performance Management (EPM) and Business Intelligence (BI) capabilities, designed to help organizations streamline their budgeting, forecasting, and reporting processes. Built to enhance financial planning and analysis activities, Jedox provides tools for data modeling, analytics, and reporting—all within a highly customizable environment.

Strengths:- Excel-like interface for ease of use: Jedox offers an interface familiar to Excel users, promoting fast adoption and reducing the need for extensive training.

- Automated, multi-dimensional modeling intelligence: When loading customer Excel files, Jedox converts them into multi-dimensional models, streamlining complex data setup.

- Dual interface options (Web and Excel): Users can seamlessly switch between a web-based interface and Excel, allowing flexibility in how they access and work with data.

- High-performance in-memory calculations: Jedox's in-memory engine supports powerful, rapid calculations, even for complex data sets, ensuring timely insights.

- Extensive APIs and out-of-the-box connectors: Jedox integrates easily with many source systems, including SAP and Microsoft Dynamics, and provides connectors for seamless integration with BI tools like Power BI, QlikView, and Qlik Sense.

- Marketplace for models and solutions: Jedox’s marketplace allows partners and customers to share pre-built models and solutions, accelerating deployment and enhancing collaboration.

While Jedox offers powerful modeling capabilities, certain aspects can be challenging:- Complex coding requirements: In-depth coding is sometimes needed for advanced modeling, which can make the tool less accessible and intuitive for non-technical users.

- Manual report and dashboard setup: Creating reports and dashboards often involves substantial manual configuration and upkeep, which can slow down implementation and require ongoing maintenance.

- Cumbersome security configuration: Setting up security protocols can be complex, adding an extra layer of effort for administrators to manage data access and permissions effectively.

- IBM Planning Analytics , IBM Cognos Controller and IBM Cognos Analytics

Overview:

IBM Planning Analitycs (IBM PA)

IBM Cognos Controller ( IBM CC)

IBM Cognos Analytics (IBM CA)

IBM offers a full suite of software applications to set-up an integrated Enterprise Performance Platform for planning, budgeting, management reporting, consolidation and BI. The software applications are complemented with strong AI functionalities powered by Watson

Strengths :- Integrated best-of-breed software: IBM’s platform combines leading functionalities across planning, budgeting, reporting, and consolidation. The planning, budgeting, and reporting tools leverage Online analytical processing (OLAP) technology, while consolidation and BI functions use relational database technology for robust performance.

- Unified data structure with embedded cubes: IBM integrates all components using embedded cubes to integrate consolidated data with analytical insights, while unifying all master data within cubes for easy access in BI processes.

- Seamless data access for end-users: The Excel integration offers easy data access, while the web interface allows for rapid deployment of data input/output templates, improving accessibility and ease of use for end-users.

- Generative AI capabilities: IBM’s generative AI functionalities enhance both data analysis and the development of analytical models, providing advanced tools for predictive insights and model creation.

- Flexible deployment options: Available as both a cloud-based and on-premises solution, IBM’s offering provides flexibility to fit diverse IT environments.

- Pricing: The platform is competitively priced, often coming in below the market average.

- Market perception of aging technology: IBM’s solutions—Planning Analytics (PA), Cognos Controller (CC), and Cognos Analytics (CA)—are often viewed as outdated. This perception can hinder adoption among users who are exploring more modern alternatives.

- Complexity in setup and maintenance: The implementation and ongoing maintenance of planning and analytical reporting can be intricate, typically requiring skilled technical expertise to navigate the complexities effectively.

- Performance dependency on developer skill: The efficiency and performance of IBM's analytical cubes are heavily influenced by the developer's expertise. This dependency can pose challenges for less-experienced teams striving for optimal performance.

- Limited availability of support partners: Although IBM has a global presence, the number of partners that support its technology can be limited. This restriction may impact organizations seeking additional resources or expertise for implementation and support.

Request a demo

Contact usHow to select your EPM tool?

When selecting an EPM tool, it's essential to consider factors such as ease of use, integration capabilities, scalability, support and budget.

- Ease of Use: To promote widespread acceptance across the enterprise, the tool should be intuitive, and user-friendly.

- Integration capabilities: It should be easy to connect the tool with current systems and data sources, offering users a unified perspective of the business.

- Scalability: As your company grows, the tool should grow accordingly to handle increasing data quantities and complexity.

- Support: Effective customer service and training are essential for optimal deployment.

- Budget: Although all tools come with a significant cost, there are substantial price differences between them.

Maximizing performance with the best EPM tool for your business

To drive your business’s profitability and maximize its performance, choosing the right EPM tool is crucial. The EPM tool that is right for your company will optimize your business processes, improve decision-making, and ensure compliance.

CCH Tagetik is a unified EPM software solution. It integrates financial and operational planning, budgeting, forecasting, and consolidation processes. Common alternatives to Tagetik include Onestream, SAP BPC, Oracle Hyperion, and Prophix (Sigma Conso). According to Gartner, these tools offer varying degrees of functionality, but Tagetik is highlighted as a Leader and Visionary for its comprehensive feature set, user-friendly interface, and long-term vision.

According to BPM Partners, a few things set CCH Tagetik apart from other vendors that provide financial consolidation and reporting solutions:

- Unified and Comprehensive Solution: Unlike many competitors, CCH Tagetik provides a fully integrated Enterprise Performance Management solution that covers not just consolidation and reporting, but also budgeting, forecasting, and extended planning (xP&A). This consolidation of data enables organizations to easily manage both financial and operational data on one screen, thus providing consistent answers and "one version of the truth" across all reporting functions..

- No Coding and Pre-Configured Solutions: CCH Tagetik is very user friendly. It has prebuilt templates that enable fast deployment,

- AI-Powered Predictive Intelligence: Using machine learning, it can improve forecasting, find key performance indicators, and let users make better decisions based on the data.

- Advanced Integration Capabilities: CCH Tagetik integrates with many different ERP systems and has advanced ETL capabilities that streamline the consolidation process and eliminate most manual intervention.

- Comprehensive Regulatory Compliance and Disclosure Management: support for regulatory compliance, including ESG reporting. Other vendors usually have to use third party solutions to obtain these functionalities.

- Scalability and Flexibility: It is a scalable solution that grows with the business and can accommodate more complex needs

Other EPM options, however, also have unique strengths. Think about Vena Solutions, Board International, Oracle Cloud EPM, OneStream, or Anaplan. These alternatives may better align with your organization's specific needs, helping you maximize efficiency, accuracy, and profitability.

Related content

-

Blog

5 reasons why TriFinance is the perfect EPM partner for your organization

-

Article

Expanding Enterprise Performance Management across the company

-

Article

The key to Finance Transformation: Simplicity and agility. A roundtable with TriFinance experts

-

Blog

Overcoming key hurdles in Finance Transformation: a guide for CFOs and Finance teams

-

Reference case

Contributing to finance transformation at VF Europe with temporary bookkeeping support

-

Reference case

Transforming Finance in EMEA for a specialty chemicals company

-

Career in Internal Team

Client Partner | Public Sector

-

Career as Consultant

Senior Finance consultant | Public sector

-

Career as Consultant

Junior Finance Consultant | Public Sector

-

Career as Consultant

Medior Finance Consultant | Public Sector

-

Career in Internal Team

Insurance expert manager

-

Career as Consultant

Young Graduate | Trainee Program