What is Finance Transformation

13 January 2025What is Finance Transformation? It refers to the strategic revision of the finance function to make it more efficient, effective, and aligned with the organization's broader goals. It involves changes to processes, technologies, organizational structures, and skillsets, enabling the finance team to move beyond traditional roles of bookkeeping and reporting to become a true business partner.

Why is Finance Transformation important

In today’s rapidly changing world, the traditional finance function is no longer sufficient. Finance transformation enables organizations to not only survive but thrive in a competitive and unpredictable environment. In this way, organizations remain competitive, agile and resilient in an increasingly complex and dynamic business environment. These are the main reasons why finance transformation is essential for your organization:

- adapting to rapid change

- supporting strategic decision-making

- enhancing efficiency and cost management

- meeting financial regulatory and compliance requirements

- driving business agility

- gaining competitive advantage: innovate faster to keep pace with industry leaders and market trends

- enhancing the role of finance as a business partner

- enhancing customer experience: improve billing, invoicing and payment processes to boost client satisfaction

- improving employee and stakeholder experience

- preparing for future growth

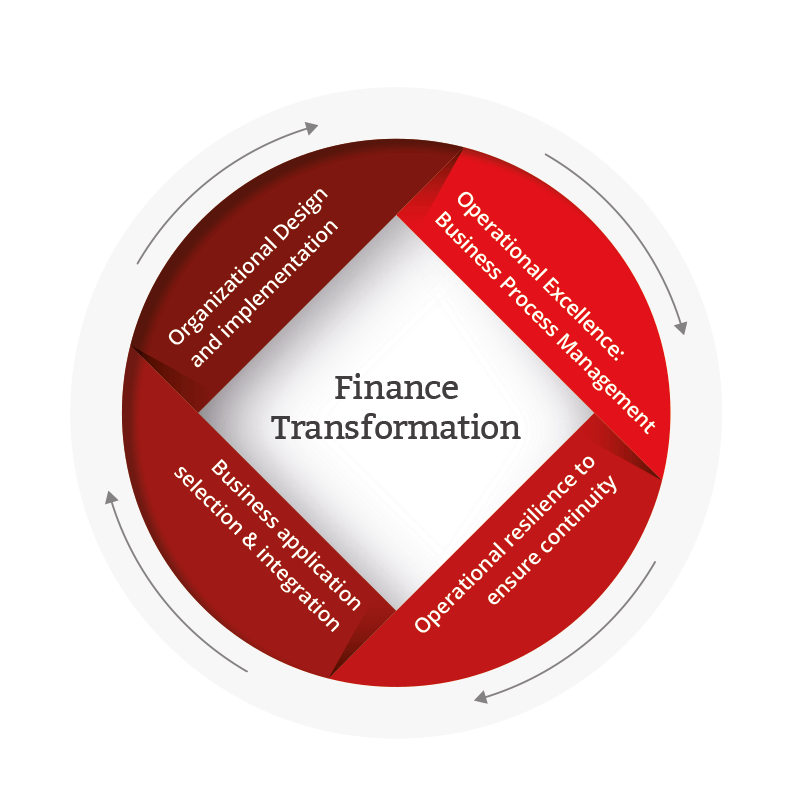

The drivers of Finance Transformation

Following our best practices, we believe the drivers of finance transformation are threefold:

- Organizational design and implementation: through Target Operating Models (TOM) and Service Delivery Models, align talent, structure and financial processes to achieve long-term business goals.

- Operational Excellence - Business Process Management: process optimization accelerates cash flow, reduces costs, increases efficiency and strengthens supplier relationships, ultimately driving business growth.

- Technology and data: Technology and data streamline operations and enhance decision-making; while providing deeper financial and business insights, reducing errors, improving efficiency and avoiding value leakage.

The essential elements of Finance Transformation

The core components of Finance Transformation can always be linked to processes, people and systems. By streamlining processes the operational speed and scalability will be improved. Building skilled teams will accelerate the adoption of new tools and strategies and by upgrading technology we enhance efficiency and data-driven decision-making.

The (financial) benefits of transformation

Finance transformation brings numerous benefits to organizations, both operational and financial. Here we list ten benefits:

- Accuracy: enhancing the quality, reliability, and real-time financial insights for strategic decisions and risk reduction.

- Agility: creating a more responsive finance function that can adapt to changing business needs.

- Better financial insights: increased transparency of financial reporting will support data-driven decision making.

- Competitive advantage: real-time insights and streamlined processes position organizations to act decisively in competitive markets.

- Cost efficiency and improved cash flow: Increased transparency leads to cost efficiency leading to operational savings and optimized resources. Faster invoicing and collection leads to optimized working capital management, and as such improved cash flow..

- Efficiency: automating manual financial processes (such as Order to Cash, Record to Report, Source to Pay, Financial Planning & Analysis, Treasury and Asset & Liability Management) and eliminating redundant tasks to reduce costs and improve speed.

- Enhanced risk management: predictive analytics and advanced monitoring tools help identify and mitigate financial risks early.

- Scalability and flexibility: modernized finance systems scale seamlessly with organizational growth or complexity.

- Strategic value: shifting the focus from transactional activities to analytical and strategic activities.

- Workforce empowerment: employees are equipped with tools and training to perform higher-value tasks like data analysis and strategic planning.

As not all benefits can be realized in the short term, it’s important to define the roadmap and priorities. One of our clients wanted to gain a better view of opportunities for automation and standardization within its Finance department as an initial step to start its journey towards operational excellence. It was the starting point of their transformation journey.

Common challenges & pitfalls

Besides the numerous benefits Finance transformation can bring, don’t forget about the challenges and pitfalls during your journey. These obstacles often arise from the complexity of integrating new technologies, changing organizational culture, and aligning processes with evolving goals.

Key challenges include:

- Resistance to change. Transformations only become successful and durable when employees feel empowered. The road to improvement always starts with knowing your people and having a clear understanding of your current organizational structure, processes, systems and controls.

- Legacy systems and infrastructure. Past choices, investments, and contingencies often led to a very complex information architecture, fragmented data and systems, a lot of re-creation and duplication and misalignment between business and IT.

- Skill gaps. Existing staff may lack the technical or methodological skills needed while upskilling employees can be costly and time-consuming.

- Data challenges. Addressing data quality challenges early on is essential for a successful transformation journey. Inconsistent, incomplete, or inaccurate data can undermine the effectiveness of new processes and systems, while consolidating data from multiple resources often comes with additional complexity.

- High initial costs. Significant upfront investments in technology and training may strain budgets.

- Complexity of implementation. Given the various drivers of finance transformation, the impact of the changes can be significant. Careful planning and resource allocation are required.

The last challenge, planning and resource allocation are primary conditions for a successful finance transformation journey.

A roadmap for successful finance transformation

Many changes have a significant impact, both on an organizational level, and financially, where ensuring business continuity during the transformation is essential. To successfully manage your finance transformation, developing a roadmap can be helpful in order to align the changes across processes, people and systems.

TriFinance can support you with the right expertise in creating and implementing such a transformation roadmap together. By combining advanced technology, optimized processes, and innovative organizational design, we strengthen your finance department with the right people and systems to drive efficiency, scalability, and data-driven decision-making. Our Finance Transformation services approach helps companies stay competitive and ready for sustainable growth.

Related insights

Find out more on Finance Transformation via these insights and be inspired to get ready for your finance transformation journey.

Related content

-

Blog

Overcoming key hurdles in Finance Transformation: a guide for CFOs and Finance teams

-

Reference case

Contributing to finance transformation at VF Europe with temporary bookkeeping support

-

Reference case

Transforming Finance in EMEA for a specialty chemicals company

-

Blog

Improving efficiency and strategic alignment at an Investment Company

-

Blog

How to leverage AI in finance processes to improve forward-looking insights

-

Blog

Europe’s green deal turns pale

-

Career in Internal Team

Client Partner | Public Sector

-

Career as Consultant

Senior Finance consultant | Public sector

-

Career as Consultant

Junior Finance Consultant | Public Sector

-

Career as Consultant

Medior Finance Consultant | Public Sector

-

Career in Internal Team

Insurance expert manager

-

Career as Consultant

Young Graduate | Trainee Program