- A strategic approach to ESG will give you a competitive advantage in the near future.

- Companies must embrace a sustainability mindset that aligns with the goal of growing shareholder value.

- Turning sustainability data into insights unlocks opportunities, overcomes challenges, and drives value for your company, the planet, and society.

In the coming years, the sustainability landscape will be significantly impacted by ESG compliance. To assist organizations in addressing these challenges and requirements, TriFinance is organizing a series of webinars on related topics to share meaningful insights and best practices.

The eleventh webinar, ‘Are you ready for CSRD compliance,' featured insights from TriFinance experts Mario Matthys and Stéphanie Struelens, who shared their knowledge with participants from various companies. They discussed the ESG compliance challenges that all companies face and the hurdles and different steps they are taking in their sustainability journeys. Gaëlle De Baeck, Sustainability Lead at TriFinance, hosted the session.

CSRD on the move

Many public interest organizations with more than 500 employees will disclose their CSRD report on 2024 for the first time. They will report on what they see as the risks and opportunities arising from social and environmental issues, and on the impact of their activities on people and the environment. We look forward to seeing their first integrated report in the first half of this year. From 2025 a broader group of companies, "the large companies" is required to disclose ESG information.

The current CSRD directive is only the beginning and in the coming years other directives and initiatives are coming up. Think about industry specific standards, voluntary adoption for SMEs (VSME) and countries aiming to harmonize CSRD with national laws, which requires stricter reporting. New directives which are announced recently, such as:

- EUDR: directive on deforestation: “deforestation-free” commodities or products;

- CBAM: Carbon Border Adjustment Mechanism: carbon intensive goods that are entering the EU;

- EED: European Energy Directive: measures to help accelerate energy efficiency;

- And audit guidelines: IAASB published a final standard on sustainability assurance engagements;

The recent climate conference ‘COP29’ in Azerbaijan was rather disappointing as no major (new) developments were announced.

Companies must embrace a sustainability mindset that aligns with the goal of growing shareholder value. This involves fostering a culture of healthy profits that balances the drive for profitability.

Stéphanie Struelens, BCB Leader Financial Institutions

The 10 common hurdles on your way to sustainability reporting

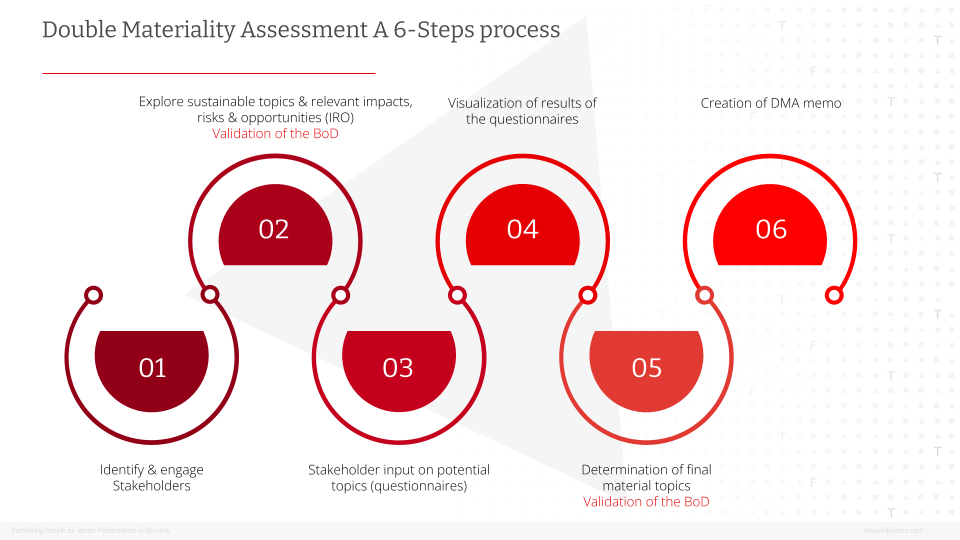

Before diving into the common hurdles on your way to sustainability reporting, keep in mind the six necessary steps you need to take in order to create maximum impact.

Hurdle 1: Lack of awareness

“Readiness checks show that quite some companies are not yet well prepared to meet upcoming ESG assurance requirements.”

We experience a lack of awareness and an underestimation of the complexity and amount of work that needs to be done. Companies who made the highest progress in meeting the reporting requirements, are the companies where the board was actively involved from the beginning. Besides that it’s important to involve other departments as soon as possible, such as HR, Sales, etc. as company wide data points need to be reported.

Hurdle 2: Jumping into data without a project plan

“Do you have an ESG strategy? Not yet… but we are already starting with capturing some data”.

Start with a plan to collect data or don’t start at all. You need to see the bigger picture before you can start capturing data on different levels. If not, this leads to a lot of rework, corrections and discussions about ownership. By defining sustainability priorities aligned with the company’s mission and stakeholder expectations, we can overcome these pitfalls. A big part of the data points are qualitative, so invest time in defining targets, policies, governance, and processes. A rush on quantitative data will have little impact.

Hurdle 3: No concrete or realistic action plans

“The gap is growing between well-prepared and less prepared companies in terms of CSRD readiness.”

This one is about action plans. The difference between companies who take the EU directive seriously or companies who stand out in limited preparation. Companies that are not well prepared miss focus, timings, ownership, etc. Who is the data owner and how to deliver data on top of other tasks? Avoid useless work by knowing exactly what is expected from you. Keep in mind dashboards to track and monitor progress and check the ownership attitude. Prioritize as not everything can be done at once.

Hurdle 4: Disclosure points requiring project plans

“Some disclosure requirements go beyond simple data points; they demand well-structured project plans.’’

Several data points require more attention, e.g.: for carbon accounting, climate risk assessment and the transition plan to decarbonize you need a project plan as they are time consuming. Check the transitional reliefs you can take in the first year of adoption, focus on the action plan and continuous improvement, if you would not be able to meet certain requirements. Disclose your action plan rather than chasing a complete collection of data points.

Hurdle 5: Absence of a solid ESG governance process

“ESG is important, but it’s not my responsibility… ask the CFO”.

ESG governance often suffers from unclear responsibilities and accountability, varying across departments and organizations. We see in many organizations that people are pinpointing at each other who should take the lead. Building your ESG equity is a strategic aspect of governance that demands a robust organizational structure, from the field to the board. Many departments are involved in ESG Governance as data points need to be collected throughout the entire organization: finance, HR, … It doesn’t matter where the ownership is taken, as long as the written and validated governance is taken care of.

Installing an efficient sustainability process is not a mission impossible. The right awareness, the right governance and an effective project plan will give you a solid base for a sustainable mindset.

Mario Matthijs, Expert Lead Corporate Reporting

Hurdle 6: Undocumented and incomplete DMA’s

“Being late, DMA is often done in a rush and without clear documentation”.

DMA is the first and the most important starting point of your CSRD journey. A few meetings and discussions are not enough to complete the DMA assessment. Document, document, document… it will be the fundament for your future ESG reporting strategy. We see that some DMAs are not passing the audit review, so take your auditor along in your journey. Let them do a readiness check. If your DMA journey would not be ok, by the end of 2025, beginning 2026, it will be challenging to meet the requirements.

Here you can find an example of a good DMA process which could support you in your journey:

Hurdle 7: Lack of data management strategy

“We didn’t realize how fragmented our data was”.

A lack of a data management strategy will definitely lead to a challenge on capturing your company data on time. Effective data management is a crucial step for a smooth ESG reporting process. It must be clearly defined before diving into the data. Reflect on how you design your data input process to ensure it aligns with your overall ESG strategy. Consider the appropriate level of granularity for capturing data, both in terms of KPIs and ownership.

See also insights from our webinar on ESG data management. Discover more about the different tooling options to capture ESG data. Depending on your data strategy, define which solution works best for your organization.

Hurdle 8: Over-Complexification

“We tried to do too much too soon”.

Aim for excellence and not perfection. 100% compliance from the start is not required by EFRAG, make sure you meet basic requirements and think of voluntary data points, a phased approach, etc. instead of presenting something that doesn’t make sense.

Start small and scale up, be pragmatic. Test and deploy some first data points before you address the other points in your data framework. Discuss your action plan with your auditors. Remain consistent and transparent and ensure your reports are reliable and correct.

Hurdle 9: It’s an integrated report. Don’t disconnect.

“Certain data requirements have a direct link with your financial statements, and can influence your financial figures”.

This hurdle is underestimated today. It’s an integrated report - ESG and finance are closely related and both teams should work closely together. The disconnection we sometimes see during an ESG journey is not the right way. Establish and maintain a close link with your financial reporting team. For example: for the valuation of new assets, impairment testing and certain “green “ claims you make, it can be very useful to think about any financial impact of them.

Hurdle 10: Build your story - Find the right balance

“How will we communicate on our balance between shareholder value and our strategic ESG goals?”.

We often see a disbalance between shareholder value and strategic ESG goals, the balance between profitability versus sustainability. Sustainability is often seen as ‘not generating shareholder value’, which is a pity. The lack of awareness is key in taking this hurdle. Build your story with the right sustainability mindset and realistic ambitions as it will build your competitive advantage and might even result in financial benefits.

In conclusion, the key message of this TriFinance ESG webinar is that climate change is the biggest existential threat to humanity today and will definitely impact your business. Companies must embrace a sustainability mindset that aligns with the goal of growing shareholder value. This involves fostering a culture of healthy profits that balances the drive for profitability. A strategic approach to ESG will undoubtedly give you a competitive advantage in the near future.

Related content

-

Blog

Overcoming key hurdles in Finance Transformation: a guide for CFOs and Finance teams

-

Reference case

Contributing to finance transformation at VF Europe with temporary bookkeeping support

-

Reference case

Transforming Finance in EMEA for a specialty chemicals company

-

Blog

Improving efficiency and strategic alignment at an Investment Company

-

Blog

How to leverage AI in finance processes to improve forward-looking insights

-

Blog

Europe’s green deal turns pale

-

Career in Internal Team

Client Partner | Public Sector

-

Career as Consultant

Senior Finance consultant | Public sector

-

Career as Consultant

Junior Finance Consultant | Public Sector

-

Career as Consultant

Medior Finance Consultant | Public Sector

-

Career in Internal Team

Insurance expert manager

-

Career as Consultant

Young Graduate | Trainee Program