Risk Management priorities in financial institutions: Credit risk, ESG integration, and Data challenges

1 July 2024Risk management is more critical than ever at the heart of financial institutions. As the financial landscape undergoes rapid changes, driven by macroeconomic volatility, geopolitical tensions, and evolving regulatory frameworks, managing credit risk has become increasingly complex. This blog post elaborates on the new dynamics in credit risk management, highlighting the key supervisory priorities set forth by regulatory authorities. We will also explore the challenges financial institutions face in integrating Environmental, Social, and Governance (ESG) data into their risk management practices.

Credit Risk: a key supervisory priority

In a recent European Central Bank (ECB) report, credit risk is considered as a focus area that requires heightened attention and action from financial institutions. This may not surprise given the rapidly evolving macroeconomic environment as well as the pressing geopolitical risks potentially severely impacting financial markets and credit portfolios.

Impact of inflation and Central Bank policies on the credit quality of loan portfolios and real estate valuations

Across Europe, banks report higher insolvencies together with increasing provisions for non-performing loans, reduced growth prospects for small and medium sized companies, surging house prices and tighter credit standards, among others.

The determining factor driving these trends since late 2022 has been the rapid increase in inflationary pressures and the corresponding hawkish Central Bank monetary policy. The latter had a strong impact on the cost of living of private individuals while altering the profitability of companies.

Additionally, real estate transactions took a hit after central banks in most economies substantially raised interest rates. In Belgium real estate prices have however remained resilient except for certain types of residential and commercial real estate. The strong decline in valuations was however short- lived and has eased or even reversed due to central banks rate cut expectations.

Furthermore, the increased cost of living and higher mortgage rates has put downward pressure on the repayment capacity of borrowers potentially resulting in higher insolvencies & corresponding increase in provisions for non-performing loans. In addition, higher mortgage rates, together with tighter credit standards, has substantially shrinked loan demand which will ultimately harm a banks’ future profitability.

Banking sector profits soar amid substantial contribution of interest rate swap valuations

In 2023 however, banks reported great results partially generated by the valuation of interest swap contracts concluded to hedge fixed rate mortgage loan exposure against interest rate risk. The increase of short-term interest rate substantially contributed to the interest received for the floating rate leg of the swap contracts. The expected rate cuts will consequently negatively impact this profitability boost.

Fortunately for banks, rate cut expectations have been continuously pushed back due to persistent inflation and worsening geopolitical tensions. This allows banks to further profit from this favorable interest rate context they operate in.

Banks should prepare for asset quality deterioration. This downturn has also been confirmed by recent surveys of the EBA suggesting a loan quality decline in most lending portfolios together with tightening lending standards and weak loan demand.

Jean-Philippe Thirion - Business Unit Leader Financial Institutions Belgium

The economic uncertainty: asset quality deterioration

Notwithstanding the great results from banks, 2024 has been characterized by downward revisions to EU growth and inflation forecasts while the uncertain economic environment continues with high geopolitical risks. Figures on bankruptcies and job losses in the manufacturing sector have evolved negatively due to the worsened Belgian competitive position following the second-round effects of inflation.

This observation also translates to the 2024 Spring supervisory update of risks and vulnerabilities in the EU Financial System. The main point here is that banks should prepare for asset quality deterioration. This downturn has also been confirmed by recent surveys of the European Banking Authority (EBA) suggesting a loan quality decline in most lending portfolios (as reflected in IFRS stage 2 allocation) together with tightening lending standards and weak loan demand.

The ESG risk factor

The financial sector must deal with a rapidly evolving regulatory environment, not only on requirements of disclosure ESG activities, but also the obligations to enhance the quality, transparency, and comparability of sustainability reporting. Regulatory authorities acknowledge certain shortcomings of contemporary regulation but also envision a streamlined regulatory package such as the SFDR regulation and the upcoming CSRD legislation.

Next to this, the transition towards sustainability and as well as climate change has created a new reality towards potential credit losses. These primarily originate from devaluations of properties & mortgages as well as rising energy costs & physical damage (impacting both proprietary portfolios and collateral valuations) and decreasing profitability of corporate clients. In this perspective, real estate corporate ratings have drifted strongly negative, more than in other economic sectors.

The ESG risk factor is strongly intertwined with credit risk. With the projection that fossil fuel reserves will deplete in the foreseeable future, it is not unimaginable that energy prices may increase significantly. Especially when energy supplies are generated by fossil fuels. Rising energy costs heavily impact the repayment capacity of lenders with a potential increase in defaults as a result. The recent energy crisis following the COVID-19 crisis has proven this statement.

In relation to energy costs, the sustainability of real estate collateral will play an important role in the years to come. The inclusion of renewable electricity as well as sustainable heating, insulation, reduced water consumption & reduced waste generation are examples of major drivers in the sustainability of a real estate holding. The EPC-score, largely capturing the sustainability level of a property, is expected to significantly impact credit risk both in terms of probability of default (via the repayment capacity of the lender) and the Loss Given Default because of the value decrease of the collateral.

Skyrocketing energy prices will make real estate with bad EPC-scores even more unattractive and further decrease its value. Banks will be forced to take up even more losses than before with a substantial effect on the capital ratios of the respective bank.

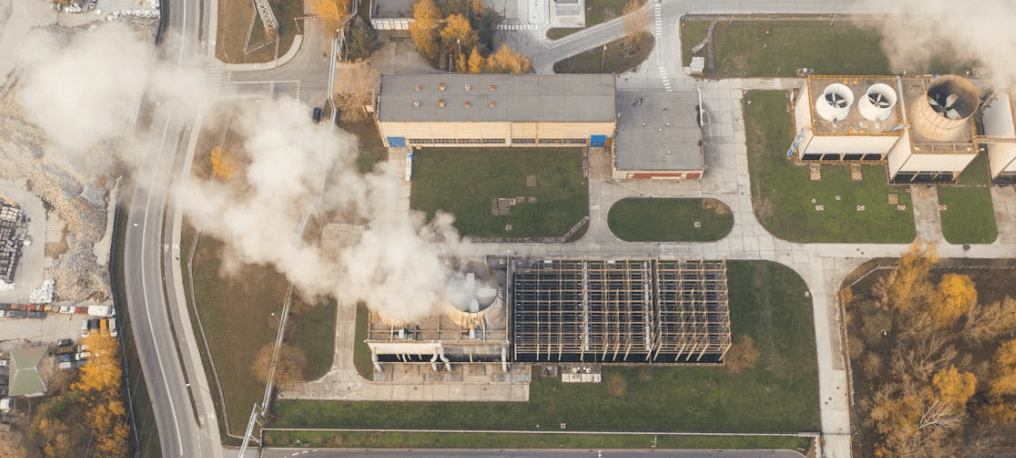

Additionally, the profitability of certain corporate clients of the financial institution is also altered due to climate change, especially those in climate change sensitive sectors like agriculture, industry, construction, power generation, ... Both physical and transitional risk will play a role here. Drought and floods may subdue the harvest of farmers while changing regulation may force industrial production firms to undergo heavy investments in GHG-reduction technologies. Either example reduces the profitability as well as the repayment capacity of said corporation.

Financial Institutions should be vigilant as the impact on capital ratios might be important in case of portfolio concentration and banks are forced to sell the underlying assets at a discount and take a considerable loss.

Jean-Philippe Thirion - Business Unit Leader Financial Institutions Belgium

Data challenges: ensuring reliable and accessible data

Recent financial and economic volatility as well as changed correlations have strongly increased uncertainty for banks in the context of acceptance and monitoring of credit risk together with successful collection processes.

A wide range of factors might impact expectations and implications for lenders both private individuals and companies.

This paradigm change is driven by multiple factors such as inflation, uncertainty about interest rates, supply chain disruptions, geopolitical concerns, idiosyncratic events and strongly changed customer experience and expectations.

The traditional ‘through the cycle’ approach used in credit modeling belongs to the past. At the same time, Regulatory Authorities have become more prescriptive about internal model use for capital purposes with more attention for governance and validation. Subsequently, Financial Institutions will increasingly apply the standardized method as multiple historical data are no longer considered reliable.

We advocate Risk Management teams to partner with the business development teams as forward- looking data have become more than ever crucial both from a Risk Management and Business development perspective.

Lance Wauters - Project Consultant for Financial Institutions

- Spotting new opportunities and value creation in credit portfolios

- Enhance speed in decision making

- Credit limit setting

- Management of concentration risk at obligor, economic sector, and collateral level

- Parameter setting for regulatory and ICAAP stress testing

- Risk Return models such as RAROC

- Early-warning signals and picking- up indications of declining credit quality

- Credit provisioning process

Reliability and availability of data remains a challenge for Financial Institutions

For Belgian retail banks, the latter can be illustrated by the EPC-scores which have proven to be a very crucial piece of information. In-depth knowledge of the degree of sustainability of the underlying assets, allows banks to properly price the loan. However, the actual problem lies in the gathering of this information. For context, across all European banks, an EPC- score can be assigned to 17% of mortgaged assets and for 65% a proxy was used according to a recent ECB- publication. This means that for about 80% of a bank’s loan portfolio, no accurate data is available.

Using artificial intelligence (AI) and machine learning techniques (ML) allow Financial Institutions to exponentially increase the amount of data that can be processed and analyzed. In the same sense, efficient data usage enables banks to accurately forecast macro- & microeconomic inputs and even prescribe different economic scenarios. When such data is available, management will be able to think out an ‘action plan’ before the problem occurs and to react agile and vigilant if the scenario were to take place in line with sound dynamic Risk Management practices.

The management of the Covid-19 pandemic impact is illustrative in this perspective. Belgian banks expected substantial losses due to loan defaults reflected by a strong increase of provisions. In the end however, these losses never materialized because of the large amounts of government stimulus households and firms received.

With appropriate and timely data in the monitoring dashboard, these stimulus packages could have been integrated in the repayment capacity assessment of corporations and households. The substantial amounts of provisions could have been used for future-oriented investments or core activities of the bank instead and contributed to the recovery of the economy.

Lastly, an important remark must be made. For AI & ML to be a successful story, data quantity is not enough. Data Quality is just as important. This requires effective governance of this new risk factor.

How TriFinance can help

Credit-related activities are a significant revenue stream for both retail and commercial banks. These activities include granting loans, credit cards, and other payment facilities that generate interest and fees. However, managing the associated credit risk has become increasingly complex. This complexity arises from several factors, such as customer expectations, heightened market volatility, faster-moving financial environments, and stricter regulatory requirements. Banks must navigate these challenges to maintain profitability and compliance.

Sound credit risk strategies: Developing robust credit risk strategies is crucial for mitigating potential losses. TriFinance assists in creating and implementing these strategies, ensuring they are aligned with the bank's overall risk management framework.

Data analytics: Leveraging data analytics, TriFinance enables banks to gain deeper insights into the credit quality of loan portfolios using advanced analytical tools.

Loan underwriting: Effective loan underwriting is key for mitigating credit risk. TriFinance supports banks in enhancing their underwriting processes.

Credit monitoring: Ongoing monitoring of credit exposures helps in identifying potential risks early. TriFinance provides solutions for continuous credit monitoring, allowing banks to detect and address issues before they escalate.

Organization of the credit department: A well-organized credit department is essential for efficient risk management. TriFinance assists in optimizing the structure and processes of the credit department to improve workflow and decision-making.

Enhancing effectiveness of the collection process: Efficient collection processes are critical for managing delinquent accounts and recovering owed funds. TriFinance helps banks streamline their collection strategies, employing best practices to maximize recovery rates and minimize losses.

By offering expertise in these areas, TriFinance supports banks in navigating the complexities of credit risk management, thereby enhancing their overall financial stability and performance.

Related content

-

Blog

How the technology of Microsoft Fabric can help you maximize the value of your data

-

Article

How Lakehouse technology can help solve your siloed data problem

-

Blog

EFRAG’s simplified ESRS: what it means and why sustainability reporting still matters

-

Blog

Webinar takeaways: How to deal with common challenges in your data projects

-

Article

Why CFOs can’t afford to ignore Data Engineering in 2025

-

Article

Power BI training: from data literacy and data modeling to strategic reporting in finance

-

Career as Consultant

Business Analyst - Banking/Insurance

-

Career as Consultant

Operations consultant - Banking

-

Career as Consultant

Treasury & Financial Markets Consultant

-

Career as Consultant

Finance professional - Banking/Insurance

-

Freelance opportunities

Freelance Assignments - Banking/Insurance

-

Career as Consultant

Medior Project Manager - Banking/Insurance